What are the Average Interest Rates on an Annuity?

The interest rates that an annuity earns largely hinge on two things: the type of annuity you have, and how the annuity is credited interest. Some annuities declare the interest rate ahead of time.

Other annuities earn interest based on ups or downs in an index, like the S&P 500 price index. Most annuities come with compounding interest. However, you may come across some contracts that offer simple interest growth.

If you are researching the potential for typical annuity interest rates, it’s important to know how annuities can differ by growth potential. Here’s some crucial information to consider as you think through your potential options.

Interest Rates for a Fixed Annuity

When someone buys a traditional fixed annuity, they will get a contract with a pre-declared interest rate. While most contracts come with compounding interest, some give you the option of simple interest. Your fixed annuity will state this interest rate beforehand. This gives contract holders the confidence of knowing how much interest they will earn and when they will get it.

Let’s put that into numbers for illustration. In this case, we will assume that a retired couple:

- Puts $100,000 into a fixed annuity,

- The fixed annuity has a 2.5% interest rate,

- The annuity goes for 4 years, and

- The annuity is credited interest on an annual basis.

When the four years have passed, you will have earned $10,381.29 in total interest. The contract will have grown to $110,381.29 in total value.

Interest Rates for a Fixed Annuity can Vary

Generally, interest rates tend to remain level. In some fixed contracts, though, you may receive higher interest in the earlier years and then lower interest in the later years. This can vary with different insurance companies and the annuity products they offer.

Sometimes the varying levels of interest crediting arise because a number of fixed annuities come with a “premium bonus.” A premium bonus is a payment of additional money, on top of your paid premium, by the insurance company into your contract.

In a few contracts, the interest from the premium bonus is credited the first year. Benefits such as a premium bonus are meant as incentives for potential buyers, but they may come with certain conditions. Make sure you walk through all of the details carefully with your financial professional.

Worried about Low Interest Rates?

Some people may not be excited by interest rates like that above. With that said, how the interest rates are set is largely linked to the underlying investments of the insurance companies issuing the annuity contracts. Those investments and their own rates are subject to the low, lingering economic interest rates we have had for some time.

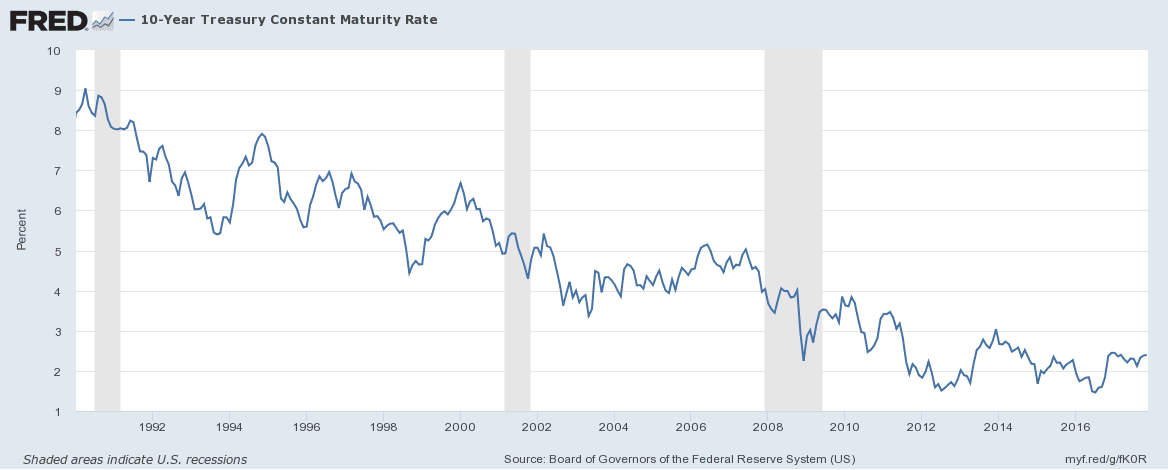

Take, for instance, a 10-year Treasury. Many insurance companies use this investment product to support annuity products and their contractual guarantees. The graph below, courtesy of the Federal Reserve Bank of St. Louis, shows how rates on the 10-year Treasury have remained extremely low.

While the Fed has been gradually increasing rates, they still remain low. There’s no certainty, either, as to when they might be higher. If you are potentially considering fixed annuities, this may be a factor to weigh in your decisions.

Interest Rates with Fixed Index Annuities

Should low interest rates on many fixed annuities not be appealing, other annuities can offer higher growth potential. Variable annuities come with the most growth opportunity, but they carry high market risk. In a variable annuity, premium dollars are put into “subaccounts,” or stocks, bond funds, commodities funds, or other funds. Some of these account products follow indices. Since these subaccount options are subject to changing market values, your principal and earned interest could be subject to losses. Since we focus on Safe Money and financial security in retirement planning, let’s look at another alternative: fixed index annuities.

Unlike a variable annuity, a fixed index annuity has no risk tied to index losses or volatility. It can earn higher interest rates than a traditional fixed annuity because of its connection to an index — like the S&P 500 price index, for example. When the index rises in value, the fixed index annuity receives interest tied to the index increase. However, since these annuities are insurance products, their interest is limited by spreads, caps, or participation rates.

So, say the S&P 500 grew 15% in a given contract year. Your fixed index annuity contract may receive 5-6% interest, for instance, depending on what the insurance company set for any caps, spreads, or participation rates at the time. Historically, fixed index annuities were developed as another option to CDs and other low interest-bearing instruments. So, they certainly can offer higher interest rates than many fixed annuities might.

The flip-side for limited growth is the protection of money. A fixed index annuity is a fixed contract, where it is credited a guaranteed minimum rate each period. In many of these contracts, the rate is 0%, meaning the contract won’t lose value due to index losses. Your principal and the interest that has already been credited remain intact.

What are the Average Interest Rates for an Annuity?

As we have seen, interest rates can vary greatly by the kind of annuity you have. So, there’s no such thing as typical or average interest rates for an annuity. It’s a matter of shopping around for different options. And as you do, it’s prudent to consider other features and benefits besides current annuity rates. You can compare the interest rates of fixed annuities to other products on the market. Should you want the potential for higher interest rates but safety for your principal, fixed index annuities can be attractive.

Remember, annuities are designed to help consumers as transfer-of-risk strategies. Those looking for high-growth opportunities will find them in other, more risk-aggressive options. However, annuities can offer some growth potential for your retirement money, along with their benefits for income, principal protection, and other goals.

Final Thoughts

The takeaway is to find the annuity that’s right for your needs, goals, financial situation, liquidity requirements, time horizon, and other objectives. If, like many other retired persons, you will be using an annuity for income, make sure it fits your income goals.

A financial professional can help you with addressing these questions and planning for retirement. If you are ready for personal guidance, financial professionals stand ready to help you at SafeMoney.com.

Use our “Find a Financial Professional” section to connect with someone directly. You can contact them with questions or request an initial goal-setting appointment. And if you need a personal referral for a financial professional, call us at 877.476.9723.