What is a 1035 Exchange?

Do you have a current annuity or insurance policy that doesn’t fit your needs well? If you are on the lookout for a new policy, a 1035 exchange may be a worthwhile option.

A 1035 exchange is a section of the U.S. tax code that lets policyholders replace an existing annuity or insurance policy with a new policy – and with no tax consequences. This tax-free exchange may be used for life insurance policies, modified endowment contracts (MECs for short), and non-qualified annuities toward a new policy.

With new waves of innovation available – such as living benefits for terminal illnesses or long-term care situations – you might wish to explore new options. The good news is you don’t have to keep your current policy forever.

Let’s take a closer look at how a 1035 exchange may and may not benefit a policyholder looking for new annuity or insurance choices.

How a 1035 Exchange Works

A 1035 exchange refers to Section 1035 of the Internal Revenue Code. Those code provisions enable you to transfer funds from a non-qualified annuity, a MEC, or a life insurance policy into a qualifying new policy without having to pay taxes.

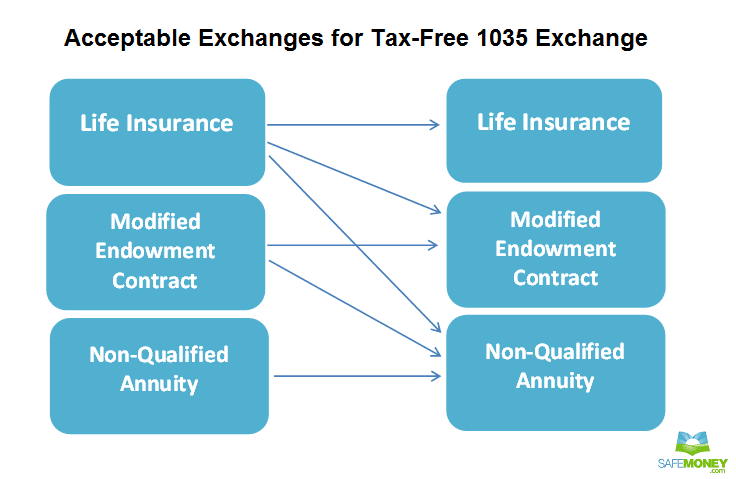

Section 1035 includes a “like-kind” rule for a tax-free exchange. Your current policy can be exchanged only for a limited number of kinds of other policies.

This is one of many reasons why it’s important to pay careful attention to what you do with your 1035 exchange request. That way it happens on a tax-neutral basis, and no slip-ups occur where you will end up with a tax bill.

Speaking of mistakes, here’s a more common one. For no taxes to be due, the actual transfer of policy funds must be from current insurance company to new insurance company.

In other words, the carrier with your current policy must transfer the funds directly to the carrier issuing the new policy. An exchange with you, as the policyholder, directly handling the to-be-transferred funds at some point could wind up with you paying taxes on them.

What Like-Kind Exchanges Qualify for a 1035 Exchange?

Under IRS tax rules, the following exchanges in the flowmap below are permitted.

In other words, these exchanges may qualify as tax-free exchanges:

- Life insurance for life insurance

- Life insurance for non-qualified annuity

- Life insurance for modified endowment contract

- Modified endowment contract for modified endowment contract (certain conditions apply)

- Modified endowment contract for non-qualified annuity

- Non-qualified annuity for non-qualified annuity

Mistakes with a 1035 Exchange can be Taxing

The IRS has strict guidelines on how these 1035 exchanges should be handled. One misstep could change your potentially tax-neutral event into a taxable event.

Here are a few guidelines for avoiding this situation:

- Keep it the same. That means the owner, the insured, and the annuitant on the new contract must be identical to those of the existing policy.

- As briefly mentioned earlier, the exchange must take place directly between the insurance companies. This keeps it a hands-free transaction and protects the tax-free treatment.

- Don’t cash out then buy the new annuity. Uncle Sam is going to want to take a cut of those proceeds.

What Else is There to Know About a 1035 Exchange?

Existing insurance policies shouldn’t ever be ended before the issuance of a new policy. You don’t want to be without a policy and that gap could create a taxable event.

A 1035 exchange must take place within a certain length of time to qualify. Be sure to ask about the timeline before you start the process.

Is a 1035 Exchange Right for You?

Before committing to an exchange, weigh your decision carefully. You should be well-versed in what’s involved, including the potential pros and cons of a 1035 exchange and any new policy replacing your current one. Not only that, any replacement with a new policy should more than make sense for you on a personal as well as financial basis.

That being said, justifiable reasons for a 1035 exchange may go beyond exploring the merits of this option. They might be motivators for wanting a new insurance or annuity policy in general.

Since we don’t live in a one-size-fits-all world, here are some reasons you might want to investigate a 1035 exchange for your current policy:

- You need another contract that has features or benefits that your current contract doesn’t have, such as tax-free benefits for long-term care needs.

- Your existing contract has fees or costs that you feel are too high, especially for benefits or features that you may not need.

- You believe your existing annuity holds too much risk. For example, many policyholders own variable annuities. They may want a fixed-type annuity contract so their principal isn’t as exposed to market volatility risk.

- You now prefer a predictable guaranteed rate, such as what a multi-year guarantee annuity, or MYGA annuity, offers. This has growing appeal to retirement investors who just want an unchanging, fixed growth rate for their money.

- You may need stronger benefits than current contract provides, such as a higher annuity payout for example.

- You are out of the surrender period and looking for a better renewal rate than what your existing annuity gives.

- You want a positive market value adjustment to work with in your new contract.

When Might a 1035 Exchange Be Inappropriate?

It’s just as important to consider the negatives as well as the positives. So, here are some reasons you might reconsider doing a 1035 exchange at all:

- If your health has changed since the application you filled out to get your current coverage, you may face paying added premium under the new policy. Or you could even be denied coverage.

- New contestable and suicide provisions featured in many new policies negate claims that might have been paid under your existing policy.

- Being older than when you took out your existing policy could result in a higher premium rate.

- Interest may be credited differently under a new policy. It’s best to compare and contrast this when deciding whether or not to make an exchange.

- Surrender charges may arise if you surrender your existing policy.

- Different policy benefits, features, or guarantees may factor into your decision.

- Could you make a change with your existing insurer, rather than resorting to an exchange? Ask about additional coverage that might be available to you.

Other Important Considerations

When you move surrender proceeds from an original policy into a new one — which you can only do when there are no outstanding loans on it — no taxes will be due on the gain you accrued in the policy when you exchanged it. However, should the policy be surrendered without a 1035 exchange, you will have to pay income taxes on that accrual.

The accrual would be defined as the difference between the gross cash value of the contract at any time and its premium tax basis, which is the sum of funds put into the contract minus the premium for any additional benefits and minus any tax-free distributions.

What if there wasn’t any accrual in the original policy? Then you might be able to capitalize on other tax advantages that may be brought to you by a 1035 exchange. And if you are considering exchange of a life insurance policy, be mindful of how it may become a modified endowment contract (MEC).

A knowledgeable financial professional can help you walk through these considerations, as well as any others particular to your individual insurance and financial situations.

Considering a 1035 Exchange for Any of Your Owned Policies?

Yes, a 1035 exchange can be beneficial, but there are also many “what ifs” and other complexities to wade through. As you consider your options, you may want to consider working with an experienced financial professional for guidance. Many retirement savers have reported higher savings, more financial peace of mind, and better overall sense of wellness when they received professional-level financial help.

If you are ready for guidance, financial professionals at SafeMoney.com can assist you. Use our “Find a Financial Professional” section to connect with someone directly. Should you need a personal referral, call us at 877.476.9723.